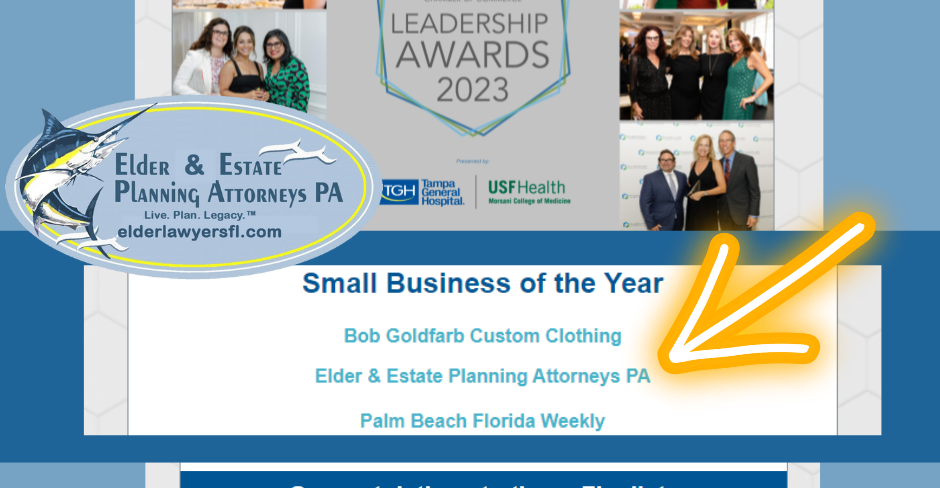

Our firm is so excited to be included in the top three finalists for the Palm Beach North Chamber of Commerce Leadership Awards 2023: Small Business of the Year! We are honored to be included with the other local leaders in our community. This year’s Annual Leadership Awards celebrate Palm Beach North’s outstanding leaders and businesses making a difference in this community and we are excited to be a part of it.

Our goals at Elder and Estate Planning Attorneys PA is to be a law office small enough to provide personal service but large enough to provide service. Our law firm will guide you through legal challenges involving elder law, estate planning, trusts, veterans benefits, real estate, and more. We work with clients through Florida, specifically in Jupiter, as well as Palm Beach, Martin, St. Lucie, and Indian River Counties in Florida.

Our elder law firm consists of seasoned attorneys in Florida with decades of experience in:

- Wills and Trusts

- Asset Protection

- Advanced Estate Planning

- Elder Law

- Veteran’s Benefits Planning

- Medicaid Benefits Planning

- Representation of Fiduciaries

- Real Estate Services

- Residential and Commercial Leases

- Business Law

- Litigation

- Probate and Trust Litigation

- Probate and Trust Administration

We work hard to ensure you will receive personal services as you make some of the most important decisions in your life. The extra benefit when you work with our law firm? You will have the assurance that your decisions will be for the best under the guidance of experienced lawyers.

Our firm is led by the exceptional Anne’ Desormier-Cartwright who, in 1985, began her practice as a real estate, landlord tenant and commercial trial lawyer. Since 1994, her practice expanded to include guardianship, mental health, probate and trust administration, and trusts and estate planning, as well as Special Needs trusts, Medicaid and Veterans Benefits Planning. More recently, she started helping clients with remedies for elder exploitation.

She is a Charter member of ElderCounsel, a nation wide association of elder law attorneys focused on the changing laws affecting the elderly. She is also a member of WealthCounsel and Advisors Forum which focuses on how the laws affect wealth planning and distribution of assets throughout a client’s life and at death. Ms. Desormier also enjoys active memberships in NAELA and AFELA, the National Academy of Elder Law Attorneys and Academy of Florida Elder Law Attorneys, respectively. These organizations lead the way for understanding and preparing legislation to address the complicated issues our elderly population faces as they age.

She is also a 30 year member of The Greater Palm Beach Chapter of National Association of Women in Construction and has served on the Board of Directors in various capacities. She continues to be a member helping members in their business succession, estate planning, elder law and real estate needs.

We encourage you to take a minute out of your schedule to congratulate our entire firm on this tremendous achievement and let us know how we may help you. Our law firm will guide you through legal challenges involving elder law, estate planning, trusts, veterans benefits, real estate, and so much more. We encourage you to contact us and schedule a meeting with our attorneys.