How can you protect your finances from coronavirus complications?

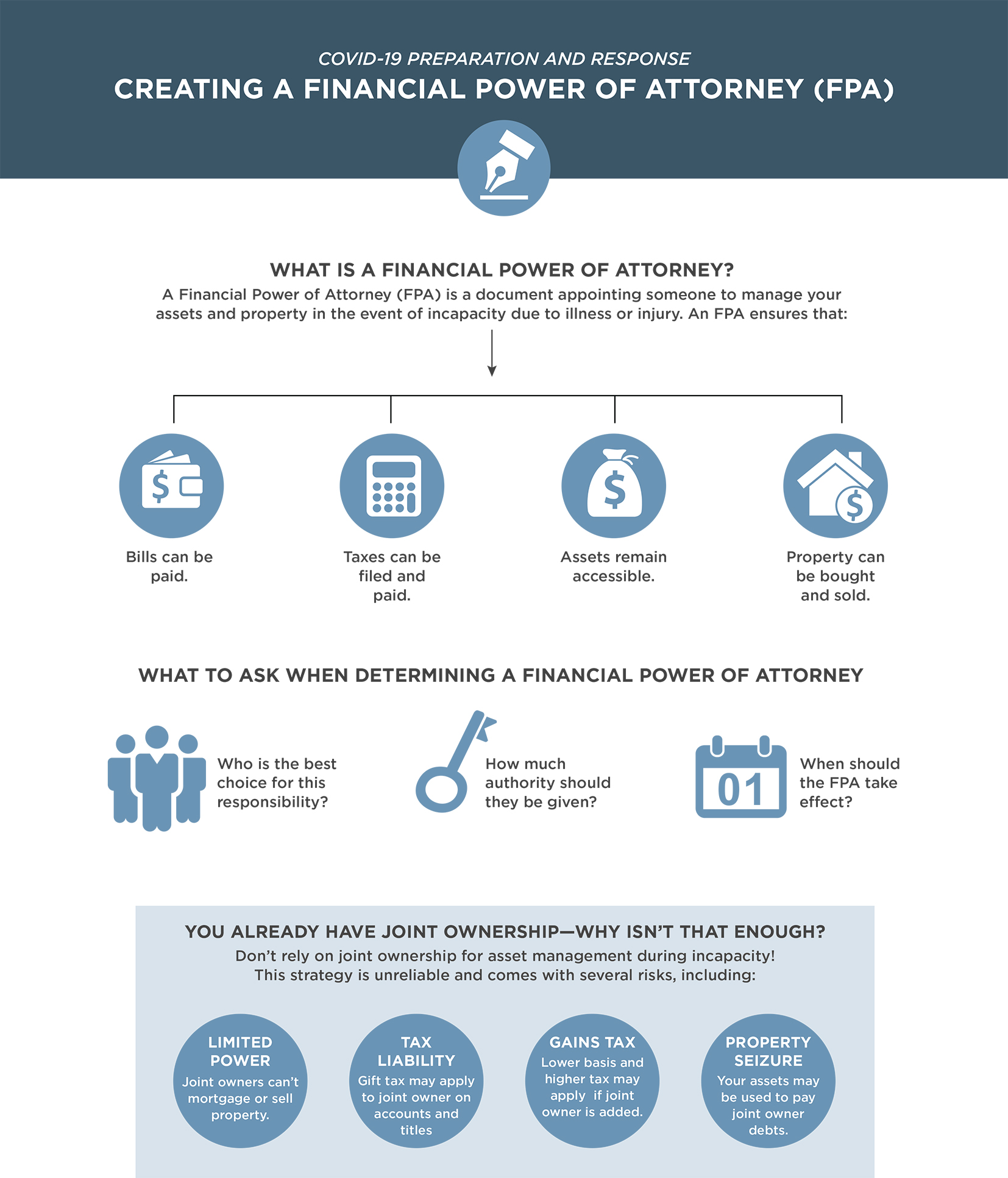

A Financial Power of Attorney (FPA) allows you to select a trusted family member or friend who will be responsible for managing your money and other property if you become mentally incapacitated (unable to make your own decisions) due to illness or injury. Without this document, bills won’t get paid, tax returns won’t be filed, bank and investment accounts held in your name will become inaccessible, retirement distributions can’t be requested, and property can’t be bought or sold.

Why holding assets jointly isn’t always enough.

If you already have a Financial Power of Attorney

An FPA can become quickly outdated—sometimes within a year. Once you get your FPA (or a complete estate plan) in place for potential incapacity, you cannot simply stick it in a drawer and forget. Instead, you need to have your FPA regularly refreshed and revisited after any major life event (such as a divorce or death) to ensure that the plan will work the way you intend it to work if it is ever needed.

We’re here to help

We can make sure that your choices are updated and right for your situation and goals.

Please contact my office now to schedule a convenient time for us to discuss your questions about an FPA and to arrange for an estate plan review. Only an up-to-date estate plan works and we’re here to help you get yours in order.