As a Florida senior, are you prepared if you have a potential need for long-term care? Did you know that as we age, the chances of requiring some form of long-term care increases. In fact, advance planning for Medicaid is an important step in preparing in advance for long-term care. Sadly, many elders and their families put off any planning until it is too late, often resulting in a crisis situation where options are limited and decisions must be made hastily.

Is there a way to avoid this stressful situation? Yes, by understanding and acting on the benefits of early Medicaid planning a person can be sure to receive the best care possible without undue financial strain. Do you have questions? We want to share four important ways that advance planning for the need for long-term care, and Medicaid, can help.

- Recognizing and understanding the urgency. Often families put off thinking about long-term care, believing it is a concern for the distant future. However, the reality is that the need for care can arise unexpectedly and leave families unprepared. In addition, putting off planning can limit a person’s options for care and significantly impact the quality and cost of the care they receive. Recognizing the need for early planning is the first step in avoiding a long-term care crisis.

- In order to access more strategies, it is necessary to begin planning early. The earlier a person begins planning for Medicaid and long-term care, the more options they will have available. What will early planning do? Early planning will allow you to:

- Preserve assets. Properly strategizing asset preservation can ensure that a person may qualify for Medicaid while retaining as much of their hard-earned assets as possible.

- Explore various care options. With more time to plan, a person can explore different types of long-term care services and facilities, choosing the one that best suits their needs and preferences.

- Implement trusts. Certain trusts and asset transfers can be used as legal strategies to protect assets, but they often require a look-back period. Early planning means you may have the time you need so these strategies can be utilized effectively.

- Learn about public benefits programs. Researching and figuring out the complexities of Medicaid and other public benefits programs can significantly reduce the burden of long-term care costs. However, these programs are often complex and have stringent qualification criteria, including asset and income limits. Understanding the eligibility requirements for Medicaid and how to structure your assets to qualify can be complex. Early planning allows time to structure finances accordingly without rush, and determine if it is right for your situation.

- Be sure your Florida estate plan includes a Durable Power of Attorney. A critical component of advance planning is establishing a durable power of attorney. This legal document allows a person to appoint someone they trust to make decisions on their behalf if they become incapacitated. A durable power of attorney can give their chosen agent the authority to manage their finances and apply to access public benefits, ensuring that their wishes are carried out even if they are unable to communicate them.

Most important is the need to work with an experienced Florida Elder Law Attorney. This is an attorney specializing in elder law and Medicaid planning who can guide a person through the application process, ensuring that they take full advantage of available programs and avoid common pitfalls that can lead to delays or denials.

Finally, planning in advance for Medicaid and long-term care is not just about securing financial resources; it is about ensuring that a person receives the care they deserve when they need it. Remember, it is never too early to start planning, and the peace of mind that comes with being prepared is invaluable.

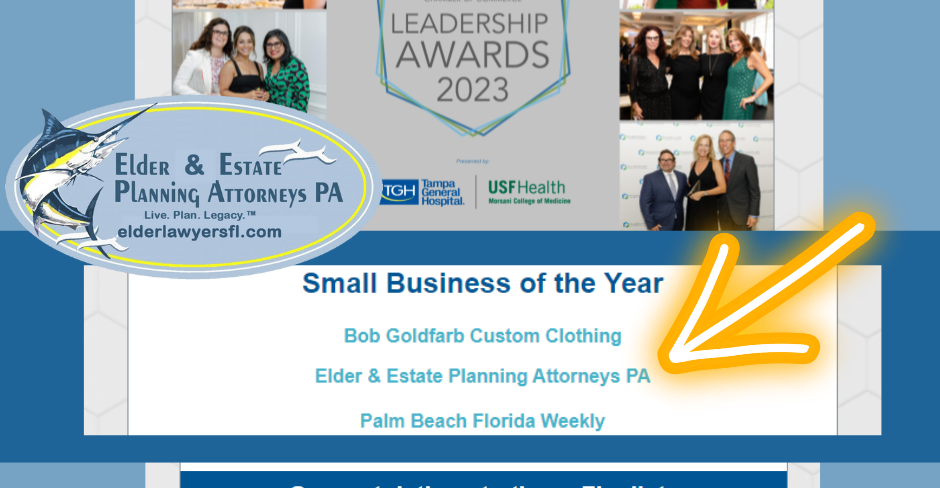

We know this article raises more questions than it answers. We know this article raises more questions than it answers. Elder and Estate Planning Attorneys, PA, is a law office small enough to provide personal service but large enough to provide service in Jupiter, as well as Palm Beach, Martin, St. Lucie, and Indian River Counties in Florida. Our law firm will guide you through legal challenges involving elder law, estate planning, trusts, veterans benefits, real estate, and more. We encourage you to contact us and schedule a meeting with our attorneys.